Strategic Commercial Real Estate Advisory for Central Florida’s Owners, Investors & Growth-Focused Organizations

Boutique advisory. Deep local relationships. Discreet execution since 2012.

1,400+ commercial transactions, CCIM, board & civic leadership, Off-market & rare property sourcing expertise

ABOUT US

We deliver client-centric commercial real estate solutions with an eye towards current and future business needs.

WHAT WE DO

Help owner-operators avoid expensive lease mistakes

Help nonprofits secure mission-aligned space

Helping investors identify off-market opportunities before they hit CoStar or Loopnet

Fighting every step of the way to ensure the client is getting the most for their investment

HOW WE DO IT

We win deals because of relationships & insight, not just services.

We study the market hard

We anticipate trends

By leveraging key relationships

And utilizing cutting edge technology

CENTRAL FLORIDA COMMERCIAL REAL ESTATE INSIGHTS

Navigating Florida’s Land Zoning Regulations: A Guide for Commercial Real Estate Owners, Investors & Tenants

Florida’s zoning landscape is one of the most influential and often misunderstood factors affecting property value, deal timelines, and long-term asset strategy. Whether you’re acquiring a new building, repositioning an existing asset, or planning a redevelopment, understanding zoning is essential to making informed decisions and avoiding costly surprises.

As a commercial real estate brokerage deeply engaged across Central Florida, we routinely help clients interpret zoning codes, identify risks early, and unlock opportunities others miss. Below is a practical breakdown of how zoning works in Florida and what every CRE decision-maker should know.

Understanding Florida’s Zoning Framework:

Florida’s zoning regulations are designed to align land use with community priorities, environmental standards, and long-range municipal planning. Every parcel is assigned a zoning designation, office, commercial, mixed-use, industrial, residential, agricultural, and dozens of sub-categories that define:

- What types of buildings and uses are allowed

- Maximum building height, density, and intensity

- Parking requirements

- Setbacks, buffers, and design standards

- Any special or conditional use approvals needed

Each municipality, from Orlando and Winter Park to Tampa, Apopka, and Daytona Beach maintains its own zoning code and land-use procedures. This means the same use may be permitted in one jurisdiction and prohibited one mile away. For commercial buyers and tenants, zoning is not just a compliance issue, it’s a valuation issue. A property’s zoning designation directly impacts its income potential, redevelopment feasibility, and exit strategy. Because zoning maps and ordinances change periodically, staying updated is essential. A zoning assumption made early in due diligence can materially impact a deal if overlooked.

Key Steps in the Zoning & Entitlement Process

Commercial real estate clients frequently encounter zoning questions when:

- Buying an office, industrial, or retail property

- Converting a building to a new use

- Expanding or improving an existing structure

- Adding parking, outdoor seating, or signage

- Repositioning assets for higher-value uses

Here’s what to expect when navigating zoning approvals in Florida:

Review Local Ordinances & Zoning Maps

Start by identifying the property’s zoning classification and permitted uses. Your brokerage team can review municipal zoning codes, past approvals, and any open violations or compliance issues.

Submit a Zoning/Use Application (If needed)

For uses not automatically permitted, you may need to submit a request for:

Conditional use approvals

Rezoning or land-use amendments

Variances or special exceptions

Applications typically include site plans, conceptual layouts, and operational details.

Municipal Review Across Multiple Departments

Planning, fire, engineering, environmental, and transportation departments may all review the request. This stage often identifies conflicts or required plan adjustments.

Community or Public Hearings (When required)

Larger or more impactful projects often require public hearings. Community feedback can influence final approvals—especially with traffic, environmental, or neighborhood-impact concerns.

Final Decision & Issuance of Zoning Approval

Once approved, the zoning authorization permits you to move forward. Additional building permits may still be required before any improvements begin.

Common Zoning Challenges in Florida CRE

- Differing Rules Across Jurisdictions

Two adjacent properties can fall under completely different zoning regimes. Misinterpreting zoning is one of the most common causes of delays during due diligence.

- Community Opposition

Traffic, density, or neighborhood compatibility concerns can surface during hearings. Early, transparent communication helps avoid surprises.

- Environmental & Coastal Restrictions

Wetlands, flood zones, stormwater requirements, and coastal high-hazard areas trigger additional regulatory layers.

- Changing Ordinances & Land-Use Codes

Municipalities regularly update zoning policies. What was allowable last year may now require special approval.

The right brokerage team ensures you’re looking around corners, not at them.

Tips for Smoothly Navigating Zoning in Florida

Engage Experts Early

Your commercial broker, along with land-use attorneys and zoning consultants, can quickly assess feasibility and highlight red flags long before you’re financially committed.

Meet With Zoning Officials Before You Invest

Early conversations create clarity around allowable uses, redevelopment potential, and required approvals.

Maintain Strong Community Engagement

For larger projects, community alignment can accelerate approvals and minimize pushback.

Keep Meticulous Documentation

Every email, plan submittal, and approval matters—especially when projects shift hands or timelines.

Use Zoning as a Strategic Advantage

Understanding what is possible versus what currently exists can uncover hidden value—whether that’s:

Assembling parcels for higher density

Repositioning a retail center

Adding outdoor operational areas

Expanding a warehouse footprint

Upgrading office to medical or mixed-use

Final Thoughts

Zoning in Florida can be complex, but with the right expertise, it becomes a strategic advantage rather than an obstacle. A knowledgeable commercial real estate brokerage helps you:

- Evaluate zoning risks and opportunities

- Align property use with municipal requirements

- Navigate hearings and approvals

- Preserve deal timelines

- Unlock untapped value

Whether you’re purchasing, leasing, or redeveloping property, proactive zoning guidance ensures your investment moves forward with confidence.

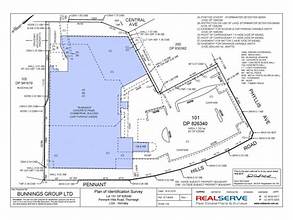

ALTA Surveys vs. Boundary Surveys: What Every Commercial Buyer Should Know

Before closing on a commercial property, due diligence begins long before the ink hits the contract — and one of the most important steps in that process is the land survey. Surveys confirm what you’re actually buying: the exact boundaries, improvements, access points, and potential issues tied to the property.

Two of the most common surveys used in real estate are the ALTA Survey and the Boundary Survey. While both define property lines, they serve different purposes and vary significantly in detail, cost, and application.

Understanding the Basics

Boundary Surveys

A boundary survey locates the property’s corners and defines its exact perimeter. It’s typically ordered before purchasing, subdividing, or improving a piece of land — especially when confirming ownership limits or checking for potential encroachments.

ALTA Surveys

An ALTA (American Land Title Association) Survey is a more detailed version of a boundary survey and represents the highest industry standard. It meets strict requirements set by both the ALTA and the National Society of Professional Surveyors (NSPS), making it the gold standard for commercial transactions.

Five Key Differences Between ALTA and Boundary Surveys

1. Level of Detail

A boundary survey defines property lines and corners.

An ALTA survey goes much further — documenting improvements, easements, access points, zoning classification, encroachments, and even optional data like flood zones, utility locations, and building dimensions.

2. Precision and Standards

Boundary surveys are accurate and sufficient for most residential and small commercial purposes.

However, ALTA surveys must conform to national standards, requiring deeper research and advanced equipment. This ensures consistency and precision across state lines — a critical factor for lenders, title companies, and national investors.

3. Use Cases

Boundary surveys are most common for smaller or local projects: home improvements, land divisions, or small property sales.

ALTA surveys, on the other hand, are almost always used for commercial real estate transactions, title insurance, and zoning compliance. They help uncover risks that could impact a deal’s value — or derail it altogether.

4. Who Orders the Survey

Boundary surveys may be requested by a property owner, buyer, or municipality (for permits or divisions).

ALTA surveys are usually commissioned by the property owner at the request of buyers, lenders, insurers, or attorneys involved in the transaction. The owner must consent to the process, even when another party initiates it.

5. Cost and Timeframe

Because of their higher level of detail and national compliance standards, ALTA surveys are more expensive and time-intensive.

-

Boundary Surveys: Start around $500 and typically take 1–2 weeks.

-

ALTA Surveys: Often start near $2,000 and can take a month or more, depending on the size, terrain, and complexity of the property.

Optional features—like detailed utility mapping or elevation data—can add cost but are often worthwhile for commercial projects.

Which Survey Do You Need?

If you’re purchasing a commercial property, obtaining an ALTA survey is typically essential. It provides the comprehensive documentation your title insurer and lender will require — and gives you peace of mind knowing the asset’s boundaries, easements, and improvements are fully understood.

For residential or minor land improvements, a boundary survey is usually sufficient.

Final Thoughts

While both surveys define property boundaries, the ALTA survey’s depth and precision make it indispensable in commercial real estate. At Lloyd Commercial Advisors, we often recommend ALTA surveys for acquisitions, sales, and developments to help clients mitigate risk and ensure smooth closings.

If you’re preparing to buy or sell commercial property in Central Florida and need guidance on which survey is right for your transaction, contact Lloyd Commercial Advisors — where expertise meets precision in every deal.

EXCITING NEWS FOR LCA PARTNERS AT ORLANDO INTERNATIONAL AIRPORT!

Huge congratulations to four of our amazing partners and clients—Foxtail Coffee Co., Kelly’s Homemade Ice Cream, Eola Wine Co., and Maxine’s on Shine—for securing coveted storefront locations at Orlando International Airport! 🌟

We’re thrilled to see these beloved local brands recognized by the Greater Orlando Aviation Authority as standout food and beverage operators, ready to share their unique flavors with travelers from around the world. 🌎 With over 53 million passengers passing through OIA annually, including being the busiest airport in Florida and the 7th busiest in the U.S., this is an incredible opportunity for exposure!

From craft coffee to gourmet ice cream, fine wines to local cuisine, these spots are now front and center for millions to enjoy. 🍦☕🍷

We couldn’t be more proud and excited for their success—wishing our friends the best of luck as they embark on this incredible new chapter! ✨ #LCAPartners #OrlandoInternationalAirport #SupportLocal #TravelEats